Disclaimer: This post may contain affiliate links. This is one way that bloggers make money, but it is at absolutely no extra cost to you if you choose to make a purchase based on my suggestions! If you would like to read more about how this works, check out my Disclosure Policy!

I have put off writing this update for quite a while, mostly because the shame, but also because it felt complicated. I realistically know that I shouldn’t hold shame with my debt because a LOT of life has happened over the last 4 years for everyone. This whole post felt like too much for one Instagram post without leaving out critical pieces of the puzzle.

So here is a little 5 year update:

Life has felt like I have been in limbo for the last 5 years.

I had paid off my last student loan in February of 2019 and was debt free! In April, I used my military benefits to put an offer in on my house and I closed in May of 2019. And because I feel a lot of feelings, this post is vulnerable and probably a little bit of an OVER explanation of the series of events.

December 2019- I found out I was pregnant very unexpectedly. Carter has been a HUGE blessing to my life and I am so thankful for him, but truthfully, I did not plan on having kids, and especially not then. I always thought if I did have kids that I wanted to be a stay at home mom/ entrepreneur, so I really ramped up trying to build income outside of the restaurant.

March 2020- COVID 19 shut down my restaurant and I lost my job that had funded a lot of my money goals. I was at home, pregnant, and fighting to build my business to keep money coming in. I am thankful that I had started diving into different streams of income before the moment that I needed it. I also did not file for unemployment during this time because I thought I didn’t qualify because I still had self employment income.

Spring 2020- I was nesting HARD and starting putting house projects on credit cards because I figured that we would be back at work quickly and could pay them off. This is where the debt cycle really started again. We were paying cash for things that we had to like the mortgage and bills, but anything that could was going on a credit card to survive. I thought this would be a lot shorter term solution.

August 2020- Carter was born and there was a wide array of messy medical bills that never really got a solution to them. I have paid almost $10,000 for the birth of my son when there were really a lot of assistance that I could have received, but was a too proud to ask for help. This was the first time that I realized how incredibly difficult financial things are for self employed because they asked for pay stubs, which I didn’t have. In hindsight, some postpartum and survival mode really kept me from dealing with some of this paperwork and it really has come to bite me in the butt.

November 2020- I launch The Savvy Budget Workbook as my first paid product and I finally felt like I was getting somewhere. But also in this space, my content shifted more to “expert budgeter” than to just me sharing my messy debt free journey. Along the way, I think I have felt like I had to have my finances together to make sales. I still swing wildly back and forth between “budget expert” and “I am trying to figure this out too” and truthfully this gives me the worst imposter syndrome on a regular basis.

June 2021- I got married to my son’s dad. In hindsight, I feel like this was a “the right thing to do” kinda move and I don’t think that I really was as confident about the decision as I should have been for something as serious as marriage. I can look back now and see a lot of the signs that it wasn’t a good decision.

July 2021- I got a Virtual Assistant/ Personal assistant job through a connection that I had. This is where I finally felt like I could breathe in our finances for a second. Steady income was coming in and I actually felt like we could make it again. This was a huge blessing for me and working for them was more than I could ever ask for.

January 2022- I returned to college to finish out my degree. I had found out that college credits expire after 10 years and that meant that my credits would start expiring in December of 2023. I started college that spring with 73 credit hours out of the 120 I needed to graduate and I knew that if I didn’t finish now, I would never get my degree.

November 2022- We bought a new to us car. We had been a one car family for almost a year and it had been difficult and frustrating. My boss at my virtual assistant job gave me a personal loan for the car because at the time I was a 1099 employee. Instead of getting a loan through a bank or the dealership, they gave me the option to pay back when I could. They knew I had paid off $36,500 the first time. They told me to just put it in savings and pay it back whenever, but because of that, I still have a full balance on the $7,000 right now.

November 2022- We bought a new to us car. We had been a one car family for almost a year and it had been difficult and frustrating. My boss at my virtual assistant job gave me a personal loan for the car because at the time I was a 1099 employee. Instead of getting a loan through a bank or the dealership, they gave me the option to pay back when I could. They knew I had paid off $36,500 the first time. They told me to just put it in savings and pay it back whenever, but because of that, I still have a full balance on the $7,000 right now.

December 2022- I asked for a divorce. This was one of the hardest, but best decisions I have made. Carter was 2. I had one semester left of college. It had gotten to a “when it happens” rather than an “if” and I knew it was time.

December 2022: I launched my No Spend Guide which has actually been my most loved and best selling product to date. It has been helpful for SO many people to figure out their finances! I love how much feedback I have gotten from people who love it!

March 2023- I got my first long contract for branded content on The Savvy Sagittarius! I have loved working with FNBO so much and they have been a huge blessing to my life and the opportunities I have had along the way. I am currently working on my 3rd contract with them.

March 2023- my son’s dad moved out of the house. We had separated and were basically living in separate spaces of the house because I was a full time student juggling too many things.

May 2023- I graduated with my Bachelor’s degree! I did not believe that day would ever come. My spring semester I was taking 17 credit hours just to graduate on time. I have a Bachelors in Psychology with a minor in Child, Youth, and Family studies from University of Nebraska. I am beyond thankful that between the military, my first debt free journey, and the Virtual assistant job, I was able to graduate with no student loans.

July 2023- My virtual assistant job ended and my income dramatically decreased. I look back and realize that getting a job here would have been wildly helpful, but that felt like I was giving up on my business. I still hold a lot of feelings about this season of life because on the outside I think it looked really successful but on the inside it feel like a chaotic mess.

October 2023- I finally actually filed for divorce. Because things were actually very civil and smooth, we had been separated, but hadn’t really touched any of the legal parts of it. Divorce made everything so up in the air and I still don’t have all of the answers that I would have wanted to have before making this update. I didn’t want to put a number out there and then explain the complicated changes happening, but here’s the transparency. I think social media sometimes makes it feel like divorce is such a quick process because of what we see, but it actually can take a lot of time.

October 2023- I started dating again. I met someone really wonderful. (He is currently gone all summer for military stuff and I would love to have some really wild and crazy goals for the summer to focus on while he is crushing goals in his career.)

January 2024- I put some business expenses on a credit card while launch my latest course. I continued to feel a lot of pressure to be a “budget expert” when that was never my goal in the first place. I am really still navigating how to deal with this back and forth. I really do love helping people and being a “coach” but I also love just sharing my journey without everything feeling so strategic and business focused. However, my course, How to Actually Stick to Your Budget is VERY psychology heavy and talks about how our habits and brains affect our money. It was so fun to put all of my psychology and money knowledge and research into one place.

March 2024- I received a medical bill from Carter’s birth that had gone into collections. I had not received anything in the mail about it for the last 3 1/2 years, but it was $3,135 from the hospital. I am shocked and honestly kinda pissed about this still. So still figuring that one out.

March 2024- I was offered equity in a startup company that I had been working with called Spendlight. It is a spending journal app that allows a place to record and reflect on your spending. I am excited to see where this path takes me this summer.

April 2024- Today, I am writing this update to say– I am entering hustle season and I am sick of debt. I am sick of paying for all of this past decisions and I am ready to CRUSH my debt goals. I feel like I need to really knock out the past so I can move on for the future that is ahead of me. To be honest, my debt feels like a daily reminder of all of the things that have happened over the last few years and I am ready to be done paying it back.

And that wraps up the last 5 years (very consolidated with a lot of happy moments in between too!) I have really learned to enjoy life more on a budget. I also built a village of the best friends that I could have ever asked for. We talk about buying land and starting a homestead on a regular basis.

When I bought my house 5 years ago, this is no where near where I expected to be. However, I am really happy with the life I have and the fact that I have been able to support myself through all of the changes, even if it did mean some debt ups and downs along the way.

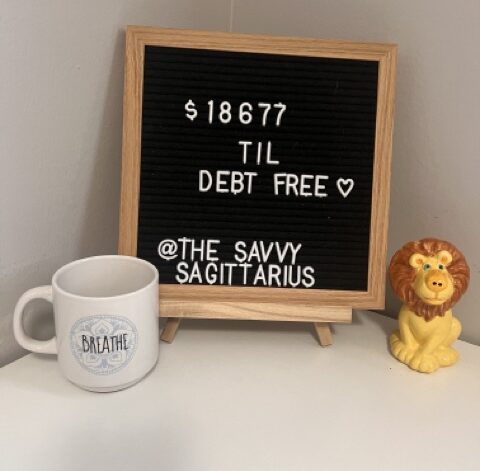

My current debt total:

| Debt | Starting |

| CC # 1 | $959 |

| CC # 2 | $1,299 |

| CC # 3 | $1,799 |

| CC # 4 | $4,485 |

| Medical # 1 | $3,135 |

| Personal Loan | $7,000 |

My plan to knock it out:

Using the debt snowball, focus on every single source of income that I can bring in for the summer.

A family friend owns a bar in town and I will be picking up some shifts there when my son is at his dads. I plan to continue to build and grow my business here and on social media. I want to continue to help grow Spendlight into a bigger company! And I am keeping an open mind about other things that come my way to bring in money to pay off debt.

I am hoping that because the medical bill is in collections (because I didn’t know about it), that I can hopefully work something out. Also, with the divorce will come partial payment on the personal loan.

My plan is 100% of the cash out from The Savvy Society membership community will go straight to debt every month.

The biggest takeaways/ things that I have learned:

I don’t want to live with debt. I can not WAIT to be debt free and not deal with it again. My biggest priority will be funding that emergency fund along the way as well!

I am extremely transparent about a lot of things, but I have struggled to share some things as they were happening because I wasn’t looking for advice on it. With a platform of almost 45k followers, transparency can sometimes mean unsolicited advice. I have spent a lot of time trying to find the balance.

I don’t actually want to be a budgeting “expert” but I do want to continue to share the things that works for me on my budgeting journey. But I also feel like I have to play games with Instagram to get the right content to show up for people sometimes. It is so frustrating sometimes to see people on the internet saying 10k months and making income claims that could be (?) true when I feel like I have been doing all of the right things and not seeing any of the financial gains. I have poured HOURS into learning business strategy and social media marketing but it really has just made me feel more disconnected with what I enjoy posting about the most. Which brings me to my next major lesson…

Sometimes budgeting really is about the income. There were plenty of times along this journey that more income would simply have bene the answer. And doing it with kids is a lot harder. Debt Free Journey Take One was easy because I didn’t have a partner and I didn’t have a kid or a house or a dog and I could move if I needed to or take on more hours or different jobs.

Your partner has a huge impact on your finances and choosing the right one can make or break your financial success.

Future financial goals:

- Pay off all my debt. $18,677: I am so ready to knock this one out. My wild and crazy goal is to be debt free again this summer. I know it will be intense and a true season of hustle, but I am excited to see what will happen.

- Emergency fund: $10,000: If the last 4 years have taught me anything, it is that I need an emergency fund and I need to prioritize it QUICK after being debt free.

- Grad School: ($15,000-$30,000): I absolutely fell in love with the science and chemistry in the brain when I went back to college. Neuroscience is fascinating to me. I consider going to grad school on a regular basis still because I would love to study money and psychology and eventually.

- Travel: $5,000: I want to take my son to alllll of the places and let him experience so many new cultures and opportunities.

- Mortgage Free by 35: I want to pay off this house if I don’t end up moving or pay it down and find something that suits our needs better. When I bought this house, I was not planning on working from home or having a kid so soon, so we have been getting creative on how to have this house fit our needs.

Keep keeping it real! You have 45,000 followers!!! That’s amazing!