Disclaimer: This post may contain affiliate links. This is one way that bloggers make money, but it is at absolutely no extra cost to you if you choose to make a purchase based on my suggestions! If you would like to read more about how this works, check out my Disclosure Policy!

That title is SOO clickbaity and made me roll my eyes a little bit so please forgive me but I have received SO this exact question in my question box on Instagram SO many times.

“How can I pay off debt as fast as possible”

There is so much shame carried with having debt sometimes that it can feel like we just want it gone so we can let go of the shame. But paying off debt can give you so many freedoms and choices. The choice to leave a bad marriage. Bad job. Bad situation in general. It can give you the option to donate to causes you are passionate about and help others! It can give you freedom!

I read a quote that said “More GOOD people need access to GOOD money so they can do more GOOD in the world.” and that is something that has motivated me to get my finances together so I can help more people and support causes I love that do good.

I have said this a few times, the formula is simple but that actual application isn’t always easy. Getting into debt didn’t happen in one day and paying it off isn’t going to happen in one either.

You likely stumbled your way into debt. It was a variety of decisions that got you here and not just one decision. So it will be a variety of decisions to get out of it. It takes intentional movement.

But I want to tell you that just because you have debt doesn’t make you a bad person. It doesn’t mean that you failed. It doesn’t even really mean that you are bad with money. It means that you were likely doing the best you could with the resources that you had at the time. You had other priorities, other things that needed your attention more urgently than managing money.

That is okay, and also I am here to help you do something about it if you are ready to make the change!

Here is the very basics of paying off debt:

1) Lower your expenses as much as you can

This is obviously easier said than done and it depends on the season of life that you are in. This starts with creating a budget and figuring out what your monthly expenses are. Figuring out where your money is going and looking at each line item is a great place to start when lowering your expenses.

This can be lowering your bills like switching to cheaper phone, internet, or insurance. It can be adjusting your spending in different categories or finding a few ways to cut out categories completely.

I created the 7 Day Money Reset to take you step by step through where your money is going now, where it needs to go and creating a budget in 7 steps! You can grab it here! This covers how to set up your budget, but also how to live on it with things like unexpected expenses, budgeting for holidays and events + lowering your impulse spending.

I do also really love doing a N0 Spend Month here and there while paying off debt. It is a chance to get a little creative and spend less money and put more towards your goal!

2) Increase your income

Unfortunately, you will find that there is a limit to decreasing your expenses. At some point, you are as bare bones as you can get and you still need more wiggle room. Increasing your income is the next step.

Depending on your goals, this might be a short term increase like Doordashing, a part time job, or another side hustle. It can also be starting your own side hustle like selling something you make or a skill that you have. This depends on what season of life you are in.

If it is possible to get a raise at your full time job, work overtime, or use the skills you have there to side hustle, this is a great place to start!

Some of my favorite side hustles have been social media help, bartending, and a few others. I have a list of the ways that I made extra income early on in my debt free journey.

3) Put the difference towards your smallest debt until it is paid off.

I LOVE the debt snowball. I know there are a lot of ways to pay off debt, but I like the debt snowball because I think it gives you quicker wins which build your money self confidence quicker. The faster you identify the first money win, feel it, and celebrate it – it gets easier to keep going after that!

The debt snowball is listing your debts in order from smallest amount to biggest amount, paying minimums on everything except the smallest debt, until that one is paid off and then applying everything to the next smallest debt.

The momentum will build quickly with paying off the first debt! When you start creating wiggle room in your budget between lowering your expenses and increasing your income, you will have money to throw at that smallest debt. When that one is paid off, tackle the next one. And the next one!

It feels so slow at first, but once you get to the last, biggest debt you are basically throwing all of the minimums you were paying towards one debt and seeing that balance decrease a lot more!

A few more tips that have helped keep me going:

Like I said, the formula is simple but that actual application isn’t always easy. It can take a lot of focused priorities and delayed gratification.

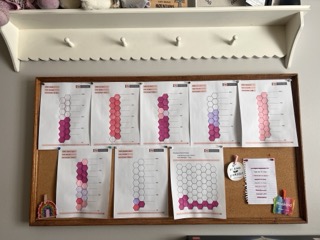

- I love these debt trackers to color in as I go to track my progress- They are available as part of my 7 Day Money Reset!

- I love this debt letter board, also to track my progress, but changing it is so exciting.

- Tracking my spending using this No Spend Tracker helps me see my money habits.

- Have an emergency fund that helps to keep you from going back into debt.

- Find people who are also working on their goals to cheer you on and share your wins– That is why I founded The Savvy Savers, a community of people on a budget to share the ups and downs with! This community has weekly meetings to chat about money and ask questions plus I am bringing in other experts to talk about money related topics!