Disclaimer: This post may contain affiliate links. This is one way that bloggers make money, but it is at absolutely no extra cost to you if you choose to make a purchase based on my suggestions! If you would like to read more about how this works, check out my Disclosure Policy!

January 2022 Budget

My goal for 2022 is to be more transparent and have accountability for our budget. I am excited to share our budgeting journey again.

If you are new here, my name is Elyse. I am married to Brandon and we have a 1 1/2 year old son named Carter.

Brandon and I went into our relationship totally debt free. I paid off all of my debt, documenting the journey here on this blog. And he paid off his debt shortly after we got together.

We found out we were expecting in December 2019, and then everything shut down in March of 2020 (causing both of us to lose our restaurant jobs. We bought a new-to-us vehicle in June of 2020 to prepare for our son to be born in August.

The combination of the new-to-us SUV, medical bills, and being without a job for a bit, landed us in $25,000 worth of debt.

- Medical: $10,000

- Escape: $7,500

- Credit Card: $7500

We started 2021 with $21,000 and ended the year with just over $14,000.

If you have not started your budgeting journey, I created The Savvy Budget Workbook to take you step by step through the process of setting up your budget. I also have a Savvy Budget Course

So here is our January 2022 Budget Overview!

January 2022 Goals:

- No Spend Month

- Pay off $1000 in debt

- Don’t use our credit cards!

- Survive the first weeks of back to college

January 2022 Income:

I have a table listed with all of our income sources. The only source I actually show as projected is my assistant income which is every other Friday.

I work for a friend who has a small business and help her with pretty much anything that she needs done including website, travel, socials, and any market research. I get $1,300 but $300 of that immediately goes to taxes and retirement before we can even touch it and then I get $600 for some group coaching I do within my assistant position.

So that $2,600 is the only income we budget off of until other income comes in because I never want to plan for income that might not come in from our other side hustles. As we have income come in from that, we make a plan for it. This month, it includes debt pay off and savings only!

Our goal for 2022 is to earn six figures as a household, so we are stepping up our hustle game this year!

Before I share our income, I want to say that January was NOT a typical month. I got a very unexpected bonus from my assistant work because profits have more than doubled since I started working for her. This was more than generous. It was supposed to be a year end bonus, but got sent with my paycheck this month.

|

Income Source |

Projected |

Actual |

|

E- Assistant |

$2600 |

$11,627 |

|

E- The Savvy Sag |

$615 |

|

| $99 | ||

| B- Epicure | $27 | |

| Misc. (Selling stuff, gift money) | $1,800 |

Total Income: $14,168

The Savvy Sagittarius Business income was $1,244 and roughly 60% goes to taxes, retirement, expenses, and sinking funds for the business. We added roughly $550 to savings and sinking funds.

Things to note:

- The bonus will not be an every month income making January numbers a little skewed

- We sold Brandon’s Jeep because we both work from home so two vehicles didn’t really make sense to keep registered, insured, and maintenance. We did put money aside from this if we change our mind in the future.

- The money from streaming takes about 30 days to process so it always seems to be behind.

- We were really focused on getting into a good routine for college, so there was less focus on some of our smaller hustles, especially after we got the bonus. But February is going

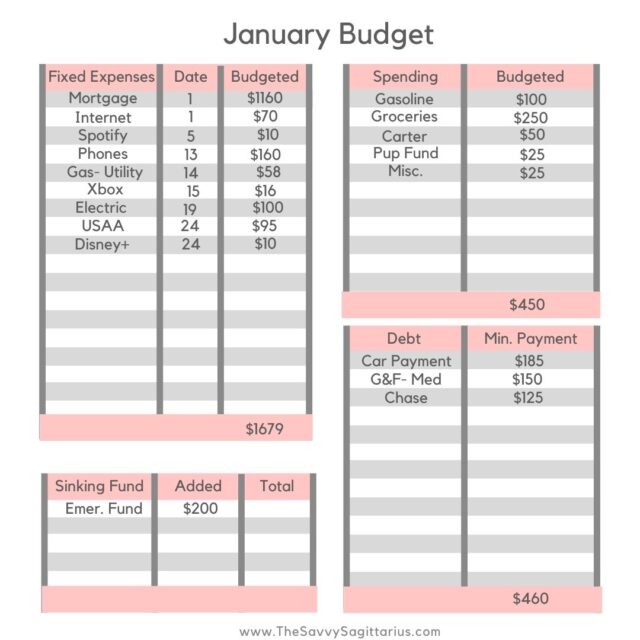

January 2022 Expenses:

Our Fixed Expenses + Spending + Debt is equal to $2,589. Our savings goals come from side hustle income. We are doing a No Spend Month in January, so this is pretty bare bones budget and aiming to pay off all of our debt this year! This budget also does not include our business budgets that we keep totally separate.

We both work from home, so we have cut our gasoline use pretty low for this month. I have a feeling that we will probably go over on our grocery budget just a little bit since we are doing a No Spend Month and not eating restaurant food.

Extra Income Plan:

Emergency Fund: $200

Christmas Fund: $50

Debt: Everything Else

January 2022 Savings:

Adding to savings isn’t one of our huge focuses right now, but it is something we have been working on little by little throughout the months. I want to keep track of it here to see the sinking funds that we add to and other little goals that we are working on here! Savings will be one of our bigger goals towards the end of the year and I am excited to be able to look at the numbers from the beginning of the year.

|

Savings Fund |

Jan 1st |

Jan 31st |

|

Emergency Fund |

$2001 | $2002 |

|

Christmas |

$76 | |

|

Vacation |

$350 |

$300 |

|

Birthdays |

$50 | |

| Car Maintenance |

$1000 |

|

| House projects | $250 |

Starting Savings: $2,351

Ending Savings: $3,678

Savings Added in January: $1,327

I moved $50 from Vacation to birthdays because we don’t have a set plan for a vacation coming up, but we do have lots of family birthdays in March and April.

$1000 in the car maintenance fund came from selling the Jeep and we will decide if we want to replace it or remain a one car family for a little while to save some money.

January 2022 Debt:

Paying down debt is our main budget focus right now as we are working on paying off debt using the debt snowball!

|

Debt |

Jan 1 |

Jan 31 |

|

Med Bill |

$ 2,327 |

$2,327 |

|

Chase |

$ 4,125 |

$1,948 |

| G&F |

$ 3,120 |

$3,120 |

|

Escape |

$ 4,870 |

PAID OFF |

|

Total Remaining: |

$ 14,442.00 |

$7,395 |

We also had $1,091 in credit card float that I annotated on the first of January after the holidays that is all cleared up now!

With the credit card float, we paid off $8,138.

We do have a pending medical bill that we are expecting to be around $2000 so that will be added to our debt in February. $9,395 remaining!

January 2022 Spending:

|

Bills |

$1,637.64 |

|

Subscriptions |

$99.84 |

|

Groceries |

$383.65 |

|

Gasoline |

$72.36 |

| Restaurant |

$116.75 |

|

House |

$169.83 |

| Baby |

$63.64 |

|

Dates |

$22.19 |

| College |

$123.64 |

|

Clothing |

$65.50 |

| Misc (Gym Stuff) |

$63 |

|

Giving |

$175.64 |

| Biz |

$411.09 |

|

Total Spent: |

$3,404.77 |

Brandon used some of his personal spending money for business related stuff. Because his gaming stuff is both business and pleasured and just starting out, we often take it out of our personal budget with the hopes that someday all of these expenses will be back in our pocket from the business. He got a new monitor, a headset and it also covers things like his Xbox Live that already came out of our budget before.

With starting college, I was for some reason surprised at how cold it was walking to campus. I got a hat, gloves, and some fleece leggings to wear to class. I also spent $123 on textbooks for classes.

We added a garage gym on a little bit of an impulse this month but I am looking forward to using it a lot more when I get into the swing of classes.

January Reflections:

I think because our income was a little higher than expected, so was our spending but I am so proud of our hard work this month.

We paid off our car. Sent some serious money to debt. Put some money in savings. But also just enjoyed life. We also CRUSHED our No Spend Month in January by only spending outside our our set expectations 7 days (and most of it was food + the winter clothes for going to class)