Disclaimer: This post may contain affiliate links. This is one way that bloggers make money, but it is at absolutely no extra cost to you if you choose to make a purchase based on my suggestions! If you would like to read more about how this works, check out my Disclosure Policy!

Having savings goals while paying off debt can feel really daunting. It can feel extremely tricky to balance between throwing all of your money towards debts and saving for things that you need to save for in the future.

I paid off all of my individual debt in February of 2019. But as we became a family, we accumulated some debt together. As of August of 2021 (when I am writing this), we are sitting at about $19,000. It is a combination of credit cards, medical bills, and a car loan that came from job loss and pregnancy during 2020. While we are paying off debt, we are also working on a few savings goals for the year.

I get the question all of the time. Should I be saving, paying off debt, or investing first? Which goal do I focus on first?

Truthfully, I can not tell you the answer to that. But I can give you a few things to think about.

- If you don’t save for this thing, are you going to go more into debt for it?

- Is this something that you KNOW you will spend money on (Birthdays, Holidays, Christmas, House stuff?)

- Is this savings goal important to you?

- How high are your interest rates on debt?

- What motivates you the most right now?

- What fits into your “dream life” the most? (Savings for a thing, paying off debt, investing to retire)

- Does doing a little bit of all 3 of them fit into your budget?

- Even if it takes longer, is doing all 3 important to you right now?

Ultimately, I can’t make the decision for you. But we are choosing to do a little bit of all three. We are investing into retirement, saving for a few goals, and paying off debt. Our big thing is narrowing our savings goals down to the ones that are actually really important to us.

I have a whole blog post about sinking funds (what they are and examples of them) to check out, but ultimately if sinking goals are too overwhelming at this time, focus on getting on your feet and paying off debt. It wasn’t really until I was debt free for the first time that I started valuing sinking funds.

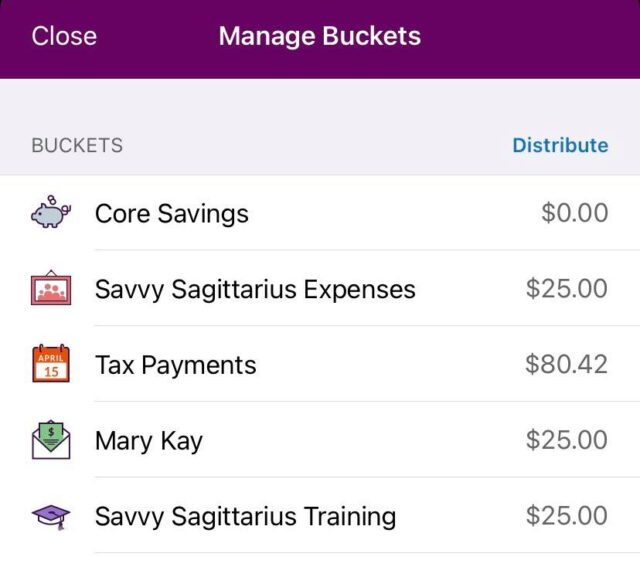

We personally use Ally bank account with their different buckets to save all of our sinking funds in one account. I like the bucket feature because you can assign different amounts to each goal without opening 100 different savings accounts. I also have a checking account at to Ally that we can use to make these purchases so we don’t necessarily have to wait 3-5 days to get the money for them. This image is my business sinking funds, but we have a personal account set up for our savings goals as well. I like that with Ally, I can really break it down.

7 Savings Goals We Are Still Focusing On While Paying Off Debt

1) Emergency Fund: $2000

This is one that we have put off for a long time. We definitely need more of an emergency fund than we have. We used part of it for our wedding because it was better than putting all of it on a credit card, but now we need to rebuild it. The original plan was to use my tax return for our wedding, but ended up not getting it in time, so we made it work for the time and now need to catch up. I am waiting on my tax return from 2020 still (as of August). But a good chuck of my return will go towards our savings goals.

We picked $2000 because it is about one month of bills without any spending. This is something that we personally feel comfortable with. But once we hit that goal and are debt free, we will plan on adding to the emergency fund more. Our long term goal is $10,000.

This is one that we won’t put aside a certain amount aside for monthly until we hit our goal of $2000. This will be more of a sprint goal to get it done quickly. Once we hit the $2000 goal, we will go to just adding $25-50 a month until we are debt free again. This helps us slowly get in the habit of adding to our emergency fund without taking away from our debt free goals.

2) Pool: $500 ($50 a month)

I posted about this on The Savvy Sagittarius Instagram yesterday, but we are buying a pool from Brandon’s brother. They just bought a house and the pool they currently have won’t work in their new yard. We are buying it for $200, but my goal is to have a little bit set aside for next year to have a little “emergency fund” for the pool related items. This money will also be used for swimming lessons, pool toys, and cleaning supplies next year.

3) House Projects: $2500 ($150 a month)

If you are a homeowner, you know that the house projects never seem to end. We have a long list of house projects that we want to complete over the next year. Things like carpeting the basement, redoing the deck, replacing all of the trim/baseboards, building storage into our bedroom closet, replacing the bathroom and kitchen floors, and finishing the fence in our yard.

It feels like this is always a savings goal when you own a home. $2,500 won’t cover all of these things but it will give us a good jump off point to be able to start some of the projects and cash flow parts of the ones that will have to wait til next summer.

4) Birthdays/Holidays 2022: $500 ($50 a month)

Brandon’s family has lots of nieces and nephews and a majority of them have birthdays between February and May. There are 17 grandchildren on his side of the family. Our goal is to be prepared to give them each $20 for their birthdays. The $500 will give us enough and we will still have a little bit leftover for holidays like Easter, Mother’s Day and Father’s Day for our family. This will also prevent having to write 5 birthday’s into one month and keep our birthday spending more consistent throughout the year.

Most of the time I try to use Fetch Rewards gift cards to cash in for our birthdays. Fetch Rewards is a receipt scanning app that gives you points for taking pictures of your receipts. You can cash those points in for gift cards when you get enough. I love the app because you can scan almost any receipt including fast food, gas stations, and groceries! You don’t have to look for specific rebates to get the most points. You can even connect your Amazon and E-mail for more points. Click here to get 2000 welcome points when you sign up for a new Fetch Rewards account!

5) Vacation: $1000 ($50 a month)

We have been talking about a vacation for what seems like forever. We are planning to do a little weekend getaway at some point before the end of the year, but we have talked about taking a good vacation for Christmas. This is one savings goal that we debated back and forth. Ultimately, we don’t want to wait til we are debt free to make memories as a family.

I plan to put aside a little bit of my tax return for this and this is another savings goal we will focus on funding a little more than just the $50 a month when we are able.

6) Car Maintenance: Ongoing ($25 a month)

Car maintenance is one savings goal that doesn’t really have an end to it, but we plan to continuously put aside $25 a month so we have it as we need it. Our thought is that it probably won’t totally pay for much, but it will soften the blow on things that we have to cash flow in the future.

We know we will need oil changes every 4-6 months in both vehicles so if anything, this will be the perfect fund for routine maintenance like those things. There is no real end goal that we are aiming to hit, but instead just being prepared for the future.

7) Electronics Upgrade: (10% of Business Income)

This is actually a business savings fund, but this is one savings goal I am extremely excited about. I need to replace my laptop that I use for pretty much all of my business work, so I have been putting aside 10% of all of my business income to a laptop fund. I am currently using my mom’s laptop, but I look forward being able to pay cash for a brand new laptop that will last me many more years for my business.

Your savings goals might be totally different.

And that is totally okay because personal finance is personal. One that isn’t included in this is Christmas. We plan to just set aside a chunk of the tax return to fully fund Christmas spending without it coming out of our regular monthly budget. We will likely top off a few of these sinking funds so they are full and out of our monthly budget as well.

Every person/ households value different things, so I love seeing other people’s sinking funds and seeing what they are focusing on with their goals. There are a thousand different things that you could have as a sinking fund, but starting with 5 or less is the perfect balance for us in paying off debt and still hitting some debt pay off goals.

What are savings goals that you focus on while still paying off debt?

Save this pin for later: