Disclaimer: This post may contain affiliate links. This is one way that bloggers make money, but it is at absolutely no extra cost to you if you choose to make a purchase based on my suggestions! If you would like to read more about how this works, check out my Disclosure Policy!

“I want to impulse shop less.”

This is the NUMBER ONE thing people tell me in my DMs when they are talking about their money goals. Impulse shopping can make you feel out of control with your budget!

Spending money, when it is budgeted for is the goal, but so many people find themselves stuck in a loop of not budgeting for something, putting it on the credit card, and using the next paycheck to pay it back instead of being able to budget for what they want to.

Or they fall into the cycle of not being able to pay off the credit card in full and it starts racking up interest.

Impulse spending can be a super slippery slope. These 5 tips are not guaranteed that you will completely stop impulse shopping, hopefully paying attention to these things can help reduce the amount you spend on it!

So here are 7 tips to help lower your impulse spending

1) Delete the apps on your phone.

This makes shopping just a little bit harder when you can’t just mindlessly open the app. I try to have the rule to only shop on my computer if I am going to online shop. Yes, I could ultimately use the browser on my phone to shop, but most of the time I will catch myself.

2) Keep a list

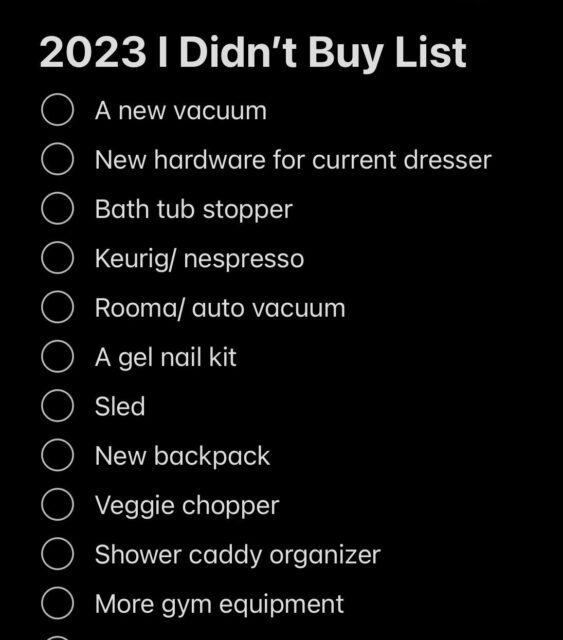

I have a list on my phone of all the things you almost impulse bought and how much I would have spent. I call mine my “I didn’t buy list.” Not only is this list great because you can see how much you have saved by not spending, it also keeps track of things you have considered buying. This means that if you do eventually buy something from your list, it was actually more intentional than impulse because it’s not the first time you have wanted this item.

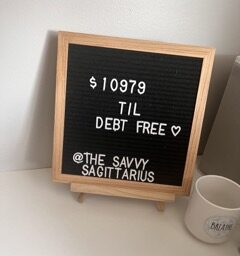

3) Have a really big goal and focus on it.

When I am working on a really big goal, it is easier for me to be intentional about my spending. If this means sending $20 to your goal every time you don’t get take out, do it! Find little ways to stay motivated! One part of this might be changing your Lock Screen on your phone or keeping a post it note at your desk to remind you of your big goals!

This goal will likely have to be something you REALLY WANT, and something that is relatively close in reach. Maybe you decide that you want to save $500 for a weekend getaway and every time you don’t impulse shop, you transfer the money you would have spent to your getaway savings! You might have the money before you know it!

4) I don’t shop “for fun”

This might make me sound boring, but I don’t just browse stores as a hobby. Walking through Target or Home Goods and “letting the store tell me what I need” is exactly what the store wants you to do. This is the biggest way to buy things you don’t need, don’t have a use for, or didn’t want in the first place.

If you want to go for a walk, pick a location outside or away from shopping. If you want to go browse at the store, leave your wallet in the car. You likely won’t go back out to the car to make a purchase. Here is a list of other fun things you can do without spending money!

5) Use pickup or curbside options

Sometimes going into the store feels like too much. Maybe you just don’t have the self control for that today. I love using the curbside pickup options for the days when I just need a few things from the store and I don’t feel like I can go into the store without picking up other items. Not going into the store reduces the amount of things you have to walk by and tell yourself no.

I really love pickup for groceries because I am able to see my total as I add things to the cart! If my cart goes over my budget, I know that I need to delete some things to make it work!

6) I don’t have my Apple Pay set up

I know people who SWEAR by how easy it is to have Apple Pay on your phone, but to me it just makes spending that much easier. My goal isn’t to make spending easier. This goes back to leaving the wallet behind when you go browse a store. I likely won’t leave my phone in the car, so not having my cards set up to my phone means I don’t always have them with me.

This tip can also include removing your card information from online shopping. If you have to go get your wallet to complete a purchase, you will have to think twice about whether you actually want to spend money on that item.

7) Track your No Spend Days!

If you have followed me on social media for even a second, you know that this is my biggest tip over and over again. I have been tracking my spending as a habit tracker since January of 2022 and it has helped me lower my impulse purchases SO much!

You can download the free tracker below and start tracking your spending habits! It has helped me decide to have no spend days more often and focus on what I ACTUALLY want to spend money on.

BONUS: Find an accountability partner!

Having friends who are on this journey with you can make the impulse shopping easier to lower because they are also doing the same! Keeping someone else accountable and having someone check on you is a great way to focus on your goals and want to do better!

The goal is to find a balance.

Overall, I hope you give yourself some grace as you figure out your finances, but that these tips can give you little wins in the moment! I also want you to know that companies like Walmart, Target, and Amazon spend BILLIONS of dollars on marketing research to try to get you to spend more money. It is not an accident that you are impulse shopping. It is all part of their plan.

If you want to be more intentional with your spending, Stop The Shop is filled with tips and tricks to lower your impulse spending, spend more intentionally and work on your money goals while still enjoying life along the way! You can get it here!