Disclaimer: This post may contain affiliate links. This is one way that bloggers make money, but it is at absolutely no extra cost to you if you choose to make a purchase based on my suggestions! If you would like to read more about how this works, check out my Disclosure Policy!

I have been talking a ton about No Spend Challenges lately, but I have received a TON of questions about them! I have done a few No Spend Months during my debt free journey that have allowed me to get ahead on paying on my student loans. Now that I am debt free, I am still doing them to ensure that some of those old habits don’t start creeping back into my budget.

To me, a No Spend Month is like a diet “cleanse” or detox. When you do a body detox, you are attempting to feel better by cleaning out the toxins and excess weight that your body is holding onto. When I do a No Spend Month, I cut out any “fun spending” and look at the fun things to do for free instead. I am cutting out excess spending to see what is more important.

During October 2017, I was able to put my whole full time paycheck towards debt and just live off of my waitressing money because I barely had any expenses. In January 2018, I was able to put over $2,500 towards my student loans right after I lost my full time temporary job. These challenges have played an essential role in my debt free journey at a few of the most challenging points since I started. In April 2019, I was able to put $2,610 towards savings with my tax return and a no spend month because I am debt free now.

Maybe you have heard people say things like “No Spend Month.” Or, this month I had “15 No Spend Days!” Well here is where it finally all gets explained if you are feeling in the dark! Here are a few of the frequently asked questions to help clear up any confusion!

What is a No Spend Challenge?

Like I said above, a no spend challenge is kind of like a detox. It is a period of time that you allow yourself to say no and cut out any excess spending. I cut out EVERYTHING. No Restaurants. No extra coffee stops. Not ordering pizza when you don’t feel like cooking. This challenge is designed to get you to think about where your money is going. It has helped me be a lot more intentional with each purchase during a month.

Like I said above, a no spend challenge is kind of like a detox. It is a period of time that you allow yourself to say no and cut out any excess spending. I cut out EVERYTHING. No Restaurants. No extra coffee stops. Not ordering pizza when you don’t feel like cooking. This challenge is designed to get you to think about where your money is going. It has helped me be a lot more intentional with each purchase during a month.

This challenge does not include bills. When I say that I didn’t spend any money all month, guys. My bills are still getting paid. Money is still going to debt/savings. I am just not using any of my normal “spending” money. I am budgeting for less things than normal.

I like to use No Spend Challenges as a way to focus on building other habits that help cut spending. When you are not spending excess money, you get in the habit of cooking food to take later. You stop shopping and can spend the month doing other things.

What can I spend money on?

During this no spend month, you can create your own rules. This is totally up to you (and your budgeting partner if you have one). My rules are pretty straight forward, but every no spend month seems to be a little different for me. I still pay my bills and put money towards debt. (duh). I would still pay for medical or car emergencies if one would arise.

For me, I have two small businesses and expenses for those business don’t count towards spending, but I try to analyze the spending closer than normal. Groceries and gasoline. These are two things that I can’t get around spending money on. I refuse to cut my already low grocery budget. I still have to go to work and my some of closest friends and family are 45 minutes away from me. I do still budget a very small amount for restaurants because I am not perfect. This is for meeting up for coffees or drinks if I have friends who come into town or I just need to get together with them!

These are things that you can decide on for yourself. Set a limit and figure it out before the month sticks to it, but don’t feel guilty if you spend money you already budgeted! That is why you planned for it. Just because you are on a budget, doesn’t mean you can’t have any fun. A budget just means a plan for your spending.

How do I know if I need one?

Is your spending absolutely out of control? Did something in your house/ on your car break and you need to save more money to fix it? Maybe you just want to start saving for the holidays because you know those are going to be expensive.

I am going back to the analogy of a diet. You know that feeling when your body just isn’t feeling your greatest. You don’t have energy and you can’t seem to get caught up for some reason. Something needs to change, and soon. If you have lost some motivation and need a little kick to jump start the wagon again.

This is a really good reason to detox your budget. Maybe you know that you are spending WAY more than you need to. A few months ago you were killing it on your budgeting and financial goals, but lately you don’t seem to know where the money is going! If you are starting to feel like something just isn’t right with your budget or you could be doing better, it might be a good time to throw one into your mix.

How long does the challenge last?

I usually say one month. If you don’t think you can make it a whole month, track your days for a month and see how many days you can not spend any money throughout the entire month. Maybe you have to spend money a couple days because of prior commitments, but make it a goal to get 15 or 20 days that you don’t spend any money! But don’t use prior commitments to spend money on other things.

Some people will start for a week or they will set a goal to not spend any money during their work week. So if you work Monday-Friday, they are allowed to spend money on the weekends, but during the week, they have to stick to their budget. All of these are good options for your very first challenge, but make sure that you don’t go crazy on your allowed spending days to make up for the days you didn’t spend!

The best part about this challenge, is that you can seriously make the challenge whatever you want to make it. A few times a year, I host a No Spend E-Mail challenge on my blog. It is a month challenge filled with a bunch of mini challenges. So if you are interested in checking that out, make sure you get signed up on for the next challenge!

What if I already have an obligation?

Some people want to give up on a no spend month because they have a (baby shower, wedding, birthday, holiday.. xxx) during the month. So they say.. maybe next month! But doesn’t every month have something going on at least one weekend?! If you continue to push it off, you will never give it a try!

My recommendation is that you set a budget for that item before the month even begins. For example, I did a No Spend Month in October 2017. I set a $70 “fall festivity” budget. I refused to miss out on the fall fun of pumpkin patches and apple orchards. So I set a budget and stuck to it! I didn’t feel like I missed out at all and I was still able to hit my goals! During April 2019, I set a budget for my uncle’s wedding. I only ended up spending half of that budget and the rest went to savings, but I didn’t count that as spending because I planned ahead at the beginning of the month.

What do I do if I can’t spend money?

It is a good time to cut out restaurants, bars, and take out. It can be a time to get really creative and start making your favorite foods at home instead. Look on Pinterest for copycat recipes and take the chance to make things at home! I have started making a list of recipes that I want to try for my upcoming month!

Find free things to do in your town that you didn’t know about! Here is a list of 37 Things you can do instead of spending money. There are a ton of great options to filling the month!

A few of my favorite no spend month activities include checking out books from my own bookshelf, which often get forgotten over the next and newest book that I get my hands on. I also try to spend the month decluttering my closet and bathroom. I really take a good look at what I have and if it really plays a role in my life or if I can get rid of it. If I can also sell things to make a little more cash, what an even better bonus!

It is pretty likely that you already have a list of things that you want to do around the house. Cleaning, reading that stack of books, catching up on a Netflix show, going through your closet and selling stuff. Almost everyone has an ongoing to do list of things that you want to do but never have time for it. Use a No Spend Month as time to stay home and cross off those things that you want to accomplish.

I am ready, but where do I start?

First, sign up for a No Spend Month FREE Tracker!

The tracker sign up at the bottom of this post will give you a free tracker, a 10 day habit journal, and 7 days of emails to prep for your month!

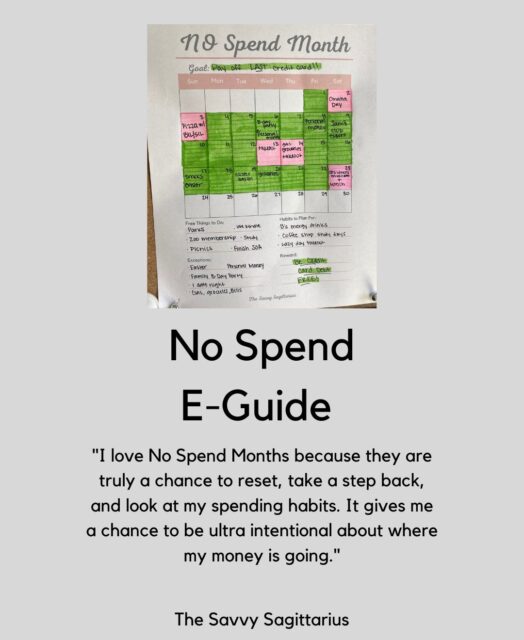

Second, check out my No Spend E Guide!

I created this $5 guide FULL of my tips and tricks for your best No Spend Month! It is full of the tips for planning, prep, during, and after! My hope is that this $5 guide will save you hundreds!

Third, Create a solid goal for what you want to accomplish.

When you create a goal like, “I want to put $2,000 to debt/savings,” it gives you a reason. When you have a goal, it allows you to remember why you aren’t spending money. This is so helpful when you start thinking about driving through Starbucks. Instead of wanting to get a coffee, you start thinking about how you could use that $6 to put towards your goal. If you don’t spend that $6 every single day, you will have $175+ at the end of the challenge!

Fourth, just jump in and do it! Don’t wait for next month.

Even if you find this post in the middle of the month, I challenge you to take the rest of the month as a #NoSpendChallenge and cut your spending back dramatically. Challenge yourself to see what you can accomplish in the rest of the month! No spend challenges have helped me cut back incredibly on things that start creeping up. Some bad habits die hard and it makes it harder to stick to your budget. If you are struggling with your budget, see how many of those little bad habits you can cut out for a week or two.

Pingback: No Spend Year: Our Focus on Intentional Spending and Living On Less - The Savvy Sagittarius