Disclaimer: This post may contain affiliate links. This is one way that bloggers make money, but it is at absolutely no extra cost to you if you choose to make a purchase based on my suggestions! If you would like to read more about how this works, check out my Disclosure Policy!

Starting to make any change in your life can be difficult. Any changes can be terrifying if you don’t know what you are getting into, but if you don’t make any changes, you will be in the exact same spot as you were one year ago. I think being stagnant in life is scarier than making a few things different in your life. Making a step by step plan to start changing can make the change not so hard. Time is still passing and you often have to make the decision of “what if I am still right here a year from now?”

The question I get the most often is probably asking for advice on how to get started. My response is usually “just start.” Just do one simple thing to change your finances. Even little things are going to help more than trying to figure out everything you need to know before you begin. My best quote is, “A year ago from now, you will wish you had started today.”

So start today. Do something.

But I also recognize when there are TONS of things on the internet about money, it can be really overwhelming to start anywhere. Maybe you are the person who has buried their head in the sand and started ignoring their finances because it brings so much anxiety.

I am not going to cure the anxiety, but I am going to help you face it with these steps. There is still a lot to be overwhelmed with, but I thinking knowing that if you take these steps and you keep going.. it will get better from here!

The goal of this blog post is to give you instructions on your first steps to start getting better with your money. However, I created my 7 Day Money Reset to go step by step through your money situation and create more actionable steps behind starting your budget. There are 1-4 minute videos with each step to help walk and talk you through each things along with a workbook to help you put numbers on paper.

But, this blog post will serve as a guide to at least help you get started.

Here are Steps to Start Chasing your Money Goals

1. Create a REAL reason why you want to budget.

There can be a lot of pressure to feel like you SHOULD be better with money, but until you have a driving factor, it can be hard to actually stick to it. You may have noticed this with fitness too. You try and try, but until you hit that sick and tired moment when you are sick of being not as fit as you would like, nothing really changes. The same goes with money.

There can be a lot of pressure to feel like you SHOULD be better with money, but until you have a driving factor, it can be hard to actually stick to it. You may have noticed this with fitness too. You try and try, but until you hit that sick and tired moment when you are sick of being not as fit as you would like, nothing really changes. The same goes with money.

In a culture where there is a lot of shame around not doing better or even the shame of “you should know better.” Shame is not a great motivator though. It actually often keeps us from facing the thing.

In order to really create you reason, I want you to sit down and journal about what you don’t like about your money situation. What things are hard? What things could be better?

And then, journal about what life could look like on the other side. When I realized that I could chase my calling on my own terms and enjoy life without as much stress. For me, a lot of my reason to start budgeting came from wanting financial freedom with kids. I wanted to create a life where I could be a stay at home mom and do the fun “Pinterest mom” activities.

I feel like nothing really changes in life until you hit that sick and tired moment where you have just had enough.

Step 2: Dream About What Life Could Be Like

This is really sub step one, but this is my favorite step. When you total everything up and you start seeing how much of your monthly income is going to debt, you are going to want to cry, (at least I did.) But afterwards, take a minute to sit back and think about what life could be like if you had that money going into your pocket every month. Think about your life without your car payments and credit cards.

If you have a significant other, I challenge you to talk to them about their goals and dreams. Maybe you want a boat or to spend every other weekend golfing. Picture life together with an abundance of money. If you are single on this journey, keep rocking on! Create a vision board of your goals, progress and successes.

While you want to be focused and cut money, remember that it is okay to enjoy life along the way too. When you start dreaming again, you can accomplish anything. Remember, Budgeting isn’t necessarily about not having any fun at all. Budget and plan for the fun things in life!

I have a Figure out your Dream Life training that takes you through 20 minutes of video + reflection questions to help you get super specific on your own dream life. You can get it HERE!

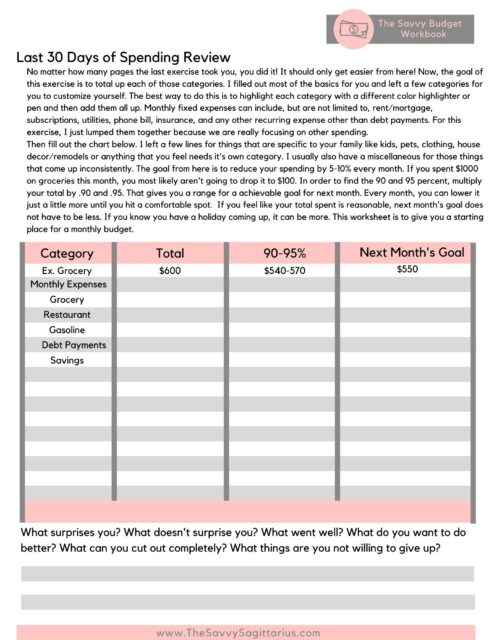

Step 3. Review your last 30 days of spending

This is such an important thing for me. DO NOT SKIP THIS STEP.

This is exactly what 7 Day Money Reset starts with.

Sit down with your bank accounts and figure out what you spent your money on for the last 30 days. You can download your bank transactions for most banks, but go through and highlight the different categories of spending into these categories.

- Bills

- Food (You can divide this into Groceries, Restaurants, Coffee/Snack Stops if you want

- Fun

- Pets or Kids

- Extra/ Misc

- Debt payments

You can break this down into more categories, but we want to at least be able to see what is going to these major categories because it will be easier to figure out what you can cut back to make some changes.

Step 4: Write out Your Fixed Expenses

Okay, now you have everything totaled up. First, we are going to focus on the fixed expenses. Fixed expenses is just a fancy way of saying bills. This can include (but is not limited to) rent/ mortgage payment, insurance, electricity/gas for your home, subscriptions and memberships, and everything else that needs paid on a set day every month. To me, these aren’t necessarily “needs” list because this can include the Netflix membership that comes out every month on the 5th.

This list is just to give you a ballpark idea of what your housing and living costs you. These don’t necessarily include credit card, car, or student loan payments, but feel free to write them down in this step. This is the first step of creating a budget.

This is also a good time to track income that came into your bank account over the last 30 days. Get an estimated amount of how much you are bringing in. After you have all of your monthly expenses, total them and your income up. What do you have left?

Step 5: Analyze at Your Extra Spending

Extra spending includes things that are variable from month to month. For me, these include groceries, eating out, gas, entertainment, kids, pets, and clothing. This pretty much includes everything that isn’t attached to a specific day of the month or that happens multiple times a month.

When you go back through your bank account for a second time, take note of how much and how often you were spending on gas and groceries. Also, check out how often you paid for food at a restaurant. When doing this, you are likely going to find that you are spending a large amount of money on food. This category isn’t going to be pretty. It is important to remember that when you start doing this, you don’t have to get rid of everything. Here are 14 Things I Still “waste money” on.

This is going to be hard, but don’t get too down on yourself. You are now taking the first steps to fixing anything. If you regularly spend cash instead, start tracking every time you spend money. When I first started this journey, I had empty credit cards. I put all of my spending on a credit card all month to see how much I was actually spending. It blew my mind how much I was throwing away every month on groceries and eating out!

Step 6: Total Up Your Debt

Once you actively take this step, it is going to be hard to turn back without a guilty conscious. This is going to be the hardest step to take and it will probably be pretty emotional.

Once you actively take this step, it is going to be hard to turn back without a guilty conscious. This is going to be the hardest step to take and it will probably be pretty emotional.

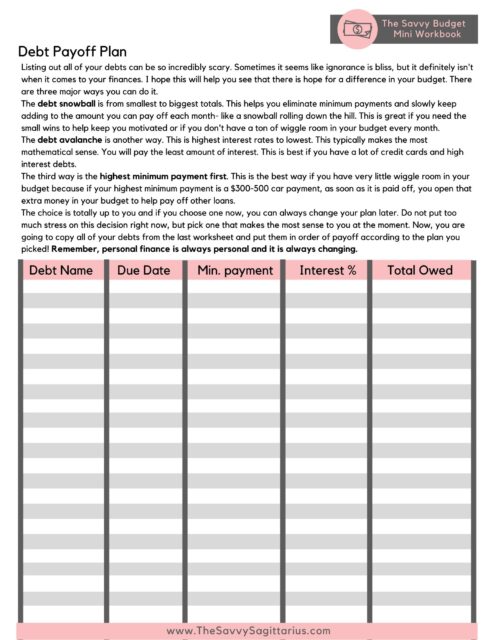

Now that you have looked at your regular spending and expenses, it is time to take a look at your debt payments. Log in to every single one of your debt accounts. This includes credit cards, medical bills, personal loans, car loans, and student loans (and anything else I could have missed). If you owe someone a significant amount of money, include that in your list.

I started The FREE Budget Workbook and just listed the account, the minimum payment owed, and the total amount owed. Add up the column to see what your total minimum payment is as well as your total debt owed. This is a starting point to making the changes that you want.

Read my blog post about creating your debt snowball to help you get rolling on paying off your debt. But first before you even START putting money towards debt- you need an emergency fund.

Step 7: Start an Emergency Fund

Emergencies will happen. It is almost inevitable to have something happen that you weren’t planning for. Having an extra rainy day bank account can make the blow of an emergency a lot easier to take. The first 3-6 months of following a budget will be sure to throw you for a loop. You will continuously be surprised by how many things you didn’t realize you were spending money on until you start tracking it.

Everyone’s emergency fund looks a little different. When you are first starting out, I recommend $1000 or 1-3 months in an separate bank account that isn’t easily accessible. For me, I chose Ally bank. This account provides me with a little bit of interest every month, but it is still accessible enough that if I needed the money, I can get to it. You don’t want to store your emergency fund in the same bank as your regular checking, because I promise you, it will get spent over and over again.

Check out my full blog post on emergency funds if you need more help with this one!

Step 8: Set a Financial Goal

Based on your monthly income and your debt, start setting a few finance related goals. Make them as realistic as possible, but you still want them to challenge you. Setting S.M.A.R.T. Goals is extremely important so you aren’t setting yourself up for failure. You want them to be specific, measurable, attainable, realistic, and timely.

I recommend setting 1 week, 30 days, and 90 day goals. Then setting one broad year goal. For example, my 1 year goal from right now is to have purchased a house. These can be as simple or detailed as you want.

Great examples:

- 1 Week Goals: Don’t eat out at all this week. Eat the food we have to cut back on groceries.

- 30 day goals: Pay off my first credit card balance. Track every penny in and out. Get current on all expenses.

- 90 days goals: Put 10-15% of our income towards debt. Pay off XXXX amount in debt.

These goals are all going to be specific based on your expenses and income. If you are only making $30,000 a year, you probably aren’t going to set a goal to pay off $6,000 in one or two months. Figure out what you can do based on your income.

Step 9: Find 3 Things to Cut Back On

Cutting back on any expenses can be hard. Starting with just a few things can be a good beginning. Maybe you have a subscription that you don’t need anymore or you temporarily decide to cut one of your monthly memberships. There are plenty of daily habits that you can slowly change to help your bank account. Start using Rakuten to save money when you are shopping online.

Cutting eating out and groceries is usually the best place to start. Most people overspend in these two categories the easiest. Here are just a few blog posts on cutting back on food expenses.

- My Number One Secret to Cutting Back on Your Grocery Bill

- 13 Ways to Avoid Eating Out

- 6 Foods to Keep at Home for Simple Meals

- How this Single, Millennial Spends Less than $200 on Food per Month

- Pantry Challenge

- Food Money Saving Guide

Step 10: Start Building More Income

If you want to hit your financial goals, you can start cutting spending from the budget, but the fastest way to hit your goals is going to be to increase your income. When I started my debt free journey, I picked up more hours at work. I started this blog. Then I got a second job. Then I got back into my Mary Kay business. I started using different phone apps to create more income as well. I started a Poshmark closet.

There are a million things that you can do to create more income. Babysit. Dogsit. Goldfish sit. Seriously. Do anything you can to create a little more income and give yourself a little bit of a lead on your debt and bills. Sell anything you can in your house on Facebook Marketplace.

I wrote an entire blog post on 10 Ways That I Make Money!

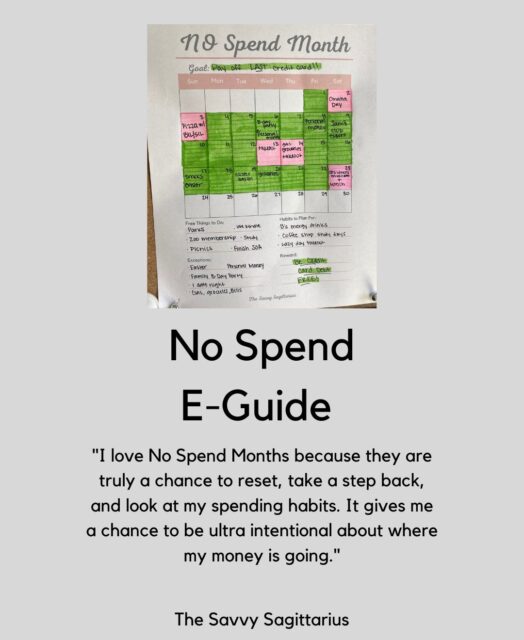

Bonus Step: Do A No Spend Challenge

These challenges can be for a few days, a week, or a month. I do one quarterly in January, April, July, and September so you can join me in my process!

I created a No Spend e- guide of ALL of my tips and tricks in ONE place after doing 20+ No Spend Challenges over the year!

If you want to start to change your finances, I suggest that you grab the FREE Budget Workbook and you start with step number one. It may not all happen today, but taking the steps in the right direction will start the change.

The long game:

Starting with the budgeting basics is great and absolutely necessary. If you are at a point where you have been through the basics a few times, set up the most perfect budget, and then fallen off the wagon a week into it, I created my course How to Actually Stick to Your Budget just for you. This course is designed to dig into the WHY you spend money and help give you actionable steps to design your a life you love around a budget that is actually realistic for your life.

If you want to dive on in, I created How to Actually Stick to Your Budget to be the combination of money psychology and budgeting experience to help you create money goals you can stick to, set a realistic budget, and