Disclaimer: This post may contain affiliate links. This is one way that bloggers make money, but it is at absolutely no extra cost to you if you choose to make a purchase based on my suggestions! If you would like to read more about how this works, check out my Disclosure Policy!

My Story

If you have been following my story at all, you probably know that I tell my story at the beginning of every monthly report for those who just stumbled upon my blog. If you have read my story, feel free to skip ahead to my monthly report. I tell this story so I am not just some stranger, but instead someone who just might inspire each and every reader to follow the same journey!

My name is Elyse. I am 22, single with no kids and I am proudly on my way to being completely debt freeeee. I never really thought of myself as someone who was in debt. With no credit cards and no car payment, I was not the average American. All I had was a few student loans. It wasn’t until a few weeks before my 22nd birthday that I got a loan for a Jeep and my very first credit card. I should say credit card(S). For the month of December, I thought it was so cool that I finally had a credit card. I was excited over it actually. I was learning about all the different rewards I could cash in and it was fantastic.

Towards the end of the month, I was cleaning off a bookshelf, getting ready to move (again), and found The Total Money Makeover: Classic Edition: A Proven Plan for Financial Fitness. This $14 book completely changed my life path at the time. Dave describes being debt free as such a rewarding and achievable thing. In his book, he says it will take work and it will be hard, but it will be worth it. He has been right. There have been days were I have completely questioned my sanity. I sometimes wonder why I don’t just make minimum payments forever like everyone else.

“Sometimes, you have to like like NO ONE else, so someday you can LIVE like no one else.” – Dave Ramsey

If you haven’t read the book, I recommend you go buy it RIGHT NOW. It will be $15 that changes your life completely. I will wait, just be sure to come back!

I officially started my debt free journey on January 1st, 2017. While progress seems slow right now, my goal is to have everything paid off by my 23rd birthday on December of 2017. I am a little uneasy about the goal, but I am going to work at it until I am debt free. I am trying not to look at the numbers and just keep looking at the goal ahead because the numbers will probably stress me out too much.

My goal is to get completely debt free, buy a house in cash, and continue to save for an even better house! I am extremely excited about the opportunities to come with my journey ahead.

But Debt Free At 23 has such a great ring to it.

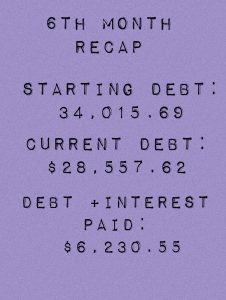

I paid off $1,533.14 in debt in June!

June was a great month for me because I spent a majority of the month in Fort Leonard Wood, Missouri (Not recommended). Spending most of my month there meant that I didn’t have a lot of day to day living expenses. I didn’t have to pay for my food or any of my own gas for my vehicle. The government kindly covered all of that in exchange for a heck of a lot of work! We did manage to have a little fun while we were down there too!

Here is what my debt snowball looks like now:

| Debt | Original | Paid This Month | Left To Pay |

| Amazon Card | $10.99 | PAID | — |

| Mary Kay Card | $275.00 | PAID | — |

| Bank Credit Card | $675.88 | PAID | — |

| Student Loan #1 | $2,087.41 | PAID | — |

| Jeep | $2,500.00 | $1,309.79 | $750 |

| Student Loan #2 | $3,550.00 | $43.35 | $3296.85 |

| Student Loan #3 | $11,634.62 | $90 | $11,481.94 |

| Student Loan #4 | $13,218.78 | $90 | $13,031.64 |

June has been my best month yet! My total left to pay is $28,560.43.

This month was on fire! I have $750 left to pay on my Jeep, then I will be down to three student loans! I am beyond thrilled about the progress made this month! Even my dad (who cosigned for my Jeep) made a comment about me putting a whole paycheck towards my Jeep this month. I guess he was surprised when it showed up on his bank account with less than $1000 left on it.

There are so many little things I want to change with my Jeep, like seat covers and a new radio, but I just can’t justify spending any money on making it nicer since I don’t own it yet.

June was my sixth month on this Debt Free Journey and I am excited to report my debt paid off amount is $6,230.55. My monthly average is $1038 which is great for just my income for my two jobs!

am excited to report my debt paid off amount is $6,230.55. My monthly average is $1038 which is great for just my income for my two jobs!

June Goal Recap:

Do better on eating out. I am only budgeting $50 for eating out.

I ate out a few times at the beginning of the month before I left and for a few meals while I was at training, but I did better with saying no. There were a few opportunities to go out as a group while at training and I turned a few of them down! I did go out a few times, because hey, you can only sit in a tin hut for so long. Money was saved. Fun was had.

I spend most of June at a training for the military, where food and housing is free/provided. $50 cash is the only money I plan to take with me to training. Once that $50 is gone, I can’t buy anything else while I am down there.

I ended up spending a little more on a new uniform, but that was because the boots that I bought didn’t fit. I did only spend about $45 on random outings, food, or things that I forgot to bring with me. My packing list ensured that I didn’t forget most things, but I still found a few that I forgot. Most of my spending down there was on food or drinks along the way!

I NEED to start focusing on my blog. I miss writing and I need to make it a priority in my life.

Ha. I failed completely at this one. I wrote on a few of my “idea” posts, but I didn’t get a single thing published. Maybe I will actually accomplish some this month. Blogging is hard work when you have two other jobs, but it is still doable. Check out how to start your own blog for 3.95 a month! (Which is 60% OFF regular price!!)

Get into the triple digits on my Jeep! I would love to have a huge chunk of the jeep paid off this month so I can focus on my higher interest student loans.

KILLED IT! $750 to go on that dang thing! By the end of the month, I will be able to fully focus on my student loans and slowly killing them down to NOTHING! I only have a little over $4,000 of debt left in my own name before I start paying the two student loans that I took out in my parents name! I am soo stoked.

Biggest lesson learned in June

This month my spending got cut to almost nothing, but that’s because this month was spent at military training. I was able to pay for almost everything before I left with money that I made in May, so everything I made this month went straight towards that Jeep! I am about to get super creative with my earning and selling this month and pick up a ton more hours at Applebee’s. Waitressing, here I come again!

Goals For July

- Finish paying off my Jeep and get started on my next student loan.

- Get my largest student loan under 13K and my smallest under 3k.

- Since I failed this month, I will write 4 blog posts this month.

- Only spend $50 on groceries and make it last through the month without eating chicken and rice all month!

- Attempt to pick up one extra serving shift a week when possible.

- Spend another two weeks at training again, which means my spending budget will be almost nothing!

How was your June? What goals do you have for July?

If you haven’t been following my journey, here are my other monthly reports:

May’s Debt Free Journey Report

April’s Debt Free Journey Report

March’s Debt Free Journey Report

Congrats girl! You’re making so much progress towards being debt free- keep up the good work!

Thanks so much! I am super excited about how it is moving now! It was a slow start, but its getting better!